A promissory note is a legitimately binding IOU: a formal, written promise in which one event accepts pay off the money they borrowed from an additional party.

A cosigned promissory note is essentially a written debenture a person. This kind of record prevails in monetary services and is something you’ve likely signed in the past if you have actually obtained any kind of type of loan. If you decide to provide money to a person, you might wish to produce a promissory note to formalize the loan.

What is a cosigned promissory note?

Promissory notes may also be referred to as an IOU, a finance arrangement, or simply a note. It’s a legal lending file that states the consumer assures to pay off to the lender a specific amount of cash according to specific specified terms. When implemented appropriately, this sort of document is legally enforceable and develops a legal commitment to pay back the funding.

Trick elements

Promissory notes are relatively uncomplicated, usually involving just two celebrations: the customer (the ‘manufacturer’) and the cash lending institution (the ‘payee’). It’s feasible to produce a secured promissory note (backed by collateral or properties) or an unsafe cosigned promissory note, depending on the type of financial obligation.read about it Note Payoff Agreement from Our Articles

No matter the type, here’s what a cosigned promissory note commonly has:

- Identification. Complete names and addresses of the manufacturer and payee.

- Funding details. The amount obtained, rate of interest (if relevant), and repayment terms, including the settlement timetable and maturity day.

- Safety or collateral. Description of properties utilized to safeguard the car loan (not applicable to unsecured cosigned promissory notes).

- Default and late repayment terms. Problems that constitute a funding default and any kind of charges for late repayments.

- Early repayment terms. Info on early repayment options and any kind of affiliated charges.

- Trademarks and days. Both celebrations should authorize and date the document for it to be legally binding.

Like various other legal files, promissory notes generally contain assorted terms or sections, such as conditions for just how to handle conflicts. It’s also a good concept to notarize the note, especially for informal contracts that are more probable to be challenged.

Cosigned promissory note examples

To better comprehend how cosigned promissory notes operate in technique, let’s evaluate 2 possible instances of exactly how they can be made use of:

1. Individual finances between family members

Buddy and relative may use a cosigned promissory note to formalize an individual loan. For instance, a current college graduate might obtain $5,000 from their parents to cover relocating expenditures for a brand-new task. In this circumstance, the promissory would usually consist of these terms:

- The $5,000 financing amount and any agreed-upon interest rate charges

- A settlement schedule (e.g., $200 regular monthly for 25 months)

- Any effects for late or missed out on payments

As long as both parties agree, the promissory note properly acts as a lawfully binding contract and holds the current grad responsible for settling their parents.

2. Vehicle loan cosigned promissory note

When financing an automobile acquisition, most lenders require the purchaser to authorize a promissory note with the car loan contract that has the complying with elements:

- Complete amount obtained

- The interest rate (APR) and financing term (e.g., 5% APR for 60 months)

- Regular monthly repayment quantity

- Details regarding late penalties and repercussions (e.g., the lending institution’s right to repossess the lorry in the event of a default)

The lender holds the promissory note until the borrower repays the lending, after which it expires (similar to a lien). In other instances, the lending institution can make use of the promissory note to collect financial debts if the customer doesn’t follow up with the terms.

When to make use of a promissory note

A cosigned promissory note is utilized for home loans, pupil fundings, car loans, business loans, and individual finances between family and friends. If you are lending a large amount of money to somebody (or to an organization), then you might wish to develop a cosigned promissory note from a cosigned promissory note layout. This note will be a legal document of the funding and will certainly safeguard you and assist see to it you are paid back.

Still, it’s vital to recognize the effects prior to you create or authorize a cosigned promissory note. Below are some advantages and disadvantages to remember:

Pros

- Defense. A cosigned promissory note shields the lending institution’s and debtor’s interests by plainly outlining each event’s obligations and civil liberties.

- Versatility. These notes can be used in various financing scenarios, from individual car loans in between close friends to official company deals.

- Much easier to get. In specific situations, securing a funding with a cosigned promissory note might be easier than going through a conventional bank.

- Keep connections. A cosigned promissory note can make clear assumptions and protect against disputes when used in casual circumstances with loved ones.

Cons

- Does not eliminate all dangers. While a cosigned promissory note provides lawful protection, there’s constantly an opportunity the borrower might miss out on settlements or default on the loan totally.

- Requires cautious composing. Like various other lawful documents, a cosigned promissory note needs to consist of the required information and abide by local laws in order to be enforceable.

- Might not cover all contingencies. In complex loaning circumstances, an easy promissory note may not address all feasible circumstances or issues that might develop.

Given the potential dangers, it’s recommended to get in touch with an attorney-especially if you’re not comfy collaborating with lawful files or if you have any concerns about your cosigned promissory note.

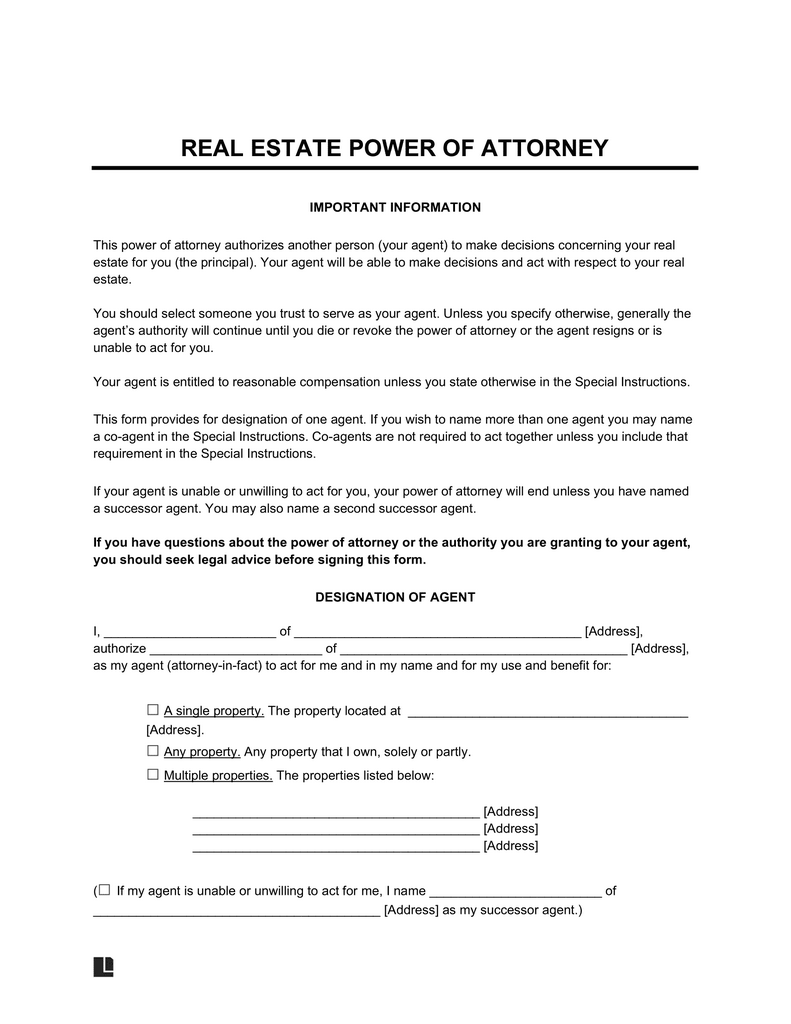

What to consist of in a promissory note

A car loan promissory note lays out all the terms and details of the car loan.

The promissory note type must consist of:

- The names and addresses of the lender and customer

- The quantity of money being obtained and what, if any kind of, security is being made use of

- How typically repayments will be made in and in what quantity

- Signatures of both events, in order for the note to be enforceable

The security referenced over is a home that the lending institution can confiscate if the note is not repaid; for instance, when you acquire a home, your home is the collateral on the home loan.

Just how to tailor a promissory note

Cosigned promissory notes ought to be produced to fit the purchase that you are involved in. It’s constantly good to refer to an example promissory note when you are creating one to make sure that you can be certain to include the right language. There likewise are different sorts of promissory notes.

A straightforward cosigned promissory note could be for a lump sum settlement on a particular date. For example, let’s claim you offer your friend $1,000 and he accepts repay you by December 1st. The total schedules on that particular day, and there is no settlement routine involved. There may or might not be interest charged on the financing quantity, depending on what you have actually concurred.

A need promissory note is one in which settlement schedules when the loan provider requests the cash back. Generally, a reasonable amount of notice is called for.

Much more difficult cosigned promissory notes for purchases like home mortgages and vehicle loan will also include rate of interest, amortization timetables, and various other information.

How to accumulate on a promissory note

If you’ve provided money to a person making use of a cosigned promissory note, the plan is for them to settle you according to the terms of the note, which for the most part is what happens. Yet suppose they don’t meet the terms of the note?

The first thing to do is in fact to request the payment in composing. A composed reminder or request is typically all that is needed. You could send past due notices 30, 60, and 90 days after the due day.

Be sure to talk to your debtor. Can they make a partial payment? Would certainly a prolonged layaway plan permit them to pay up? If you make a decision to accept a partial settlement of the financial obligation, then you can develop a debt negotiation contract with your consumer.

An additional choice is to use a financial obligation enthusiast. This business will function to accumulate your note and will generally take a percent of the debt. You additionally can offer the note to a financial obligation collector, meaning they have the loan and accumulate the total (this is similar to what takes place when financial institutions sell loans to every various other). If all else stops working, you can sue the consumer for the full amount of the debt.

Cosigned promissory notes are a beneficial way to establish a clear record of a loan-whether between entities or individuals-and to place all the relevant terms in writing, to ensure that there can be no doubt concerning the amount of cash lent and when settlements schedule.

What occurs if a promissory note is not paid?

When borrowers stop working to satisfy the payment terms, they formally default on the lending. This circumstance can result in numerous consequences:

- Credit history effect. If the lending institution reports the default to credit rating bureaus, the customer’s credit rating can drop considerably, influencing their capability to protect loans in the future.

- Collateral seizure. With secured cosigned promissory notes, the lender might deserve to take details residential property to repay the car loan.

- Lawsuit. As a last option, the lending institution may submit a lawsuit against the customer to recuperate the debt. If effective, the court may permit the lending institution to garnish salaries or area liens on the debtor’s residential or commercial property, depending on the territory’s regulations and the sort of debt.

Lawsuits can be costly and time-consuming for both parties, which is why many loan providers seek alternative remedies, as previously reviewed. In these situations, it’s highly advised to get in touch with a lawyer to protect your civil liberties.

Frequently asked questions

What are the different sorts of promissory notes?

Typically talking, promissory notes can be classified as protected (backed by collateral) or unsafe. Usual kinds include cosigned promissory notes for mortgage loans, federal student loans (additionally known as a master promissory note), vehicle fundings, and personal finances between good friends or family members, among other potential uses. It is very important to note that bills of exchange and promissory notes are not the same.

Is a promissory note lawfully binding?

Yes, an effectively implemented cosigned promissory note is legitimately binding. As long as the note has all needed elements, is authorized by the included celebrations, and adhere to appropriate regulations, it’s enforceable in court if the consumer defaults or stops working to satisfy their commitments.

Can a cosigned promissory note be transferred or sold?

Yes, a lending institution may market or move a cosigned promissory note to a financial debt collection agency if the borrower defaults. Some services might purchase cosigned promissory notes too, but this is a lot more usual in institutional or corporate financial investments with high governing oversight.

Can you write your very own cosigned promissory note?

Yes, you can write your own promissory note. Nevertheless, it’s recommended to get in touch with an attorney to ensure the legal document stands and legally enforceable. It’s additionally a good idea to get your promissory note swore to avoid future disagreements.

Who owns a promissory note?

The lender-known as the payee-is normally the proprietor of the initial cosigned promissory note till the consumer pays off the finance. In some cases (like for a home loan), the note might also be held by a financial institution or financial investment group.