As an economy of behavior, it forms the KRIPTO -valute investment strategy

The cryptocurrency market is known for its unpredictability and volatility, which makes it a challenging space for investing. However, as the market continues to develop, it is very important to succeed in understanding how the economy of behavior creates investment strategy. In this article, we will enter into ways of psychological bias that affect investor behavior and decisions and explore how these insights can be used to create effective investment strategies in the cryptic currency.

Investment Psychology

Behavior economists have identified a number of key psychological factors that contribute to investment decisions. This includes:

- A certificate of breed : tendency to seek information confirming existing attitudes or opinions.

- effect of the effect

: The tendency to relieve too much on the first information, even if incorrect.

3

non -Mare : fear of losses more than potential benefits.

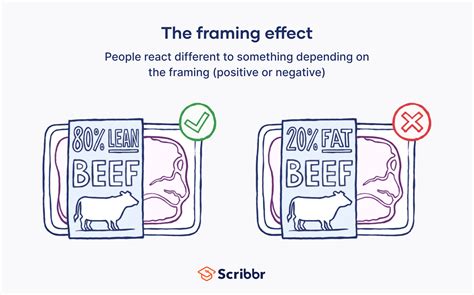

- Fraction Effect : The way you submit data can affect investing decisions.

These psychological prejudices often occur in cryptocurrency markets, where investors can influence emotions such as excitement or fear in the face of new information. For example, a sudden increase in the price of some investors can make “buying downs”, hoping to catch a low point before the price has reached.

Investment strategies based on behavioral economy

In order to surpass these bias and make informed investment decisions, it is important to consider how the economy of behavior creates the behavior of the CRIPTO currency market:

1

average value of dollar cost : This strategy involves investing in a fixed amount of money at regular intervals, regardless of the market price. By distributing investment over time, this approach can reduce the effects of emotions and help maintain a long -term perspective.

- Test loss orders : These are automatic orders to buy or sell for possible losses. When installing a suspension order, investors can avoid impulsive decisions based on recent prices fluctuations.

3

Diversification : Distribution of investment in different asset classes can reduce exposure to one specific crypto currency or market trend.

- risk management : Investors must regularly evaluate and adjust risk levels in response to market changes or individual financial position.

Occasional research: How did the economy of behavior influenced investing decisions

The cryptocurrency market has many examples of how the economy of behavior has influenced investor decisions. For example:

- 2017 Market Visibility : During the 2017 Bull race, some investors have become too optimistic, believing that the price will continue to grow indefinitely. This has led to increase demand after cryptocurrency of currency such as Bitcoin and Ethereum, prices are more than expected.

- 2018. FUD campaign : There have been several periods related to the sale of fears in the cryptocurrency market, as rumors and disinformations have expanded to possible normative changes or other issues affecting certain cryptocurrencies.

In contrast, investors who followed several tinted investment strategies, such as the average value of the dollar cost and order of suspension, could better manage their risks and move in these periods of volatility.

Conclusion

The economy of behavior plays an important role in the development of the investment strategy in the crypto currency. Understanding how psychological bias affect investors’ behavior, we can develop more effective investment approaches that help us move in the unpredictability of the market. Whether you are an experienced investor or just start, including insight into the economic behavior in your portfolio, it may be the most.

Proposals for investors

1.