Blogs

In order to allege exemption, you ought to render your boss a type W-4. Make ÔÇťExemptÔÇŁ to the function regarding the space less than Step(c) and you will finish the appropriate actions of your own setting. Getting eligible, you must have already been covered the same old payroll months (weekly, biweekly, etc.) time immemorial of the year. For those who change the level of your own withholding inside the 12 months, too much or too little income tax might have been withheld for that time one which just made the alteration. You might be in a position to compensate for so it if the boss agrees to use the fresh collective salary withholding way for others of the season. You ought to ask your workplace written down to make use of this technique.

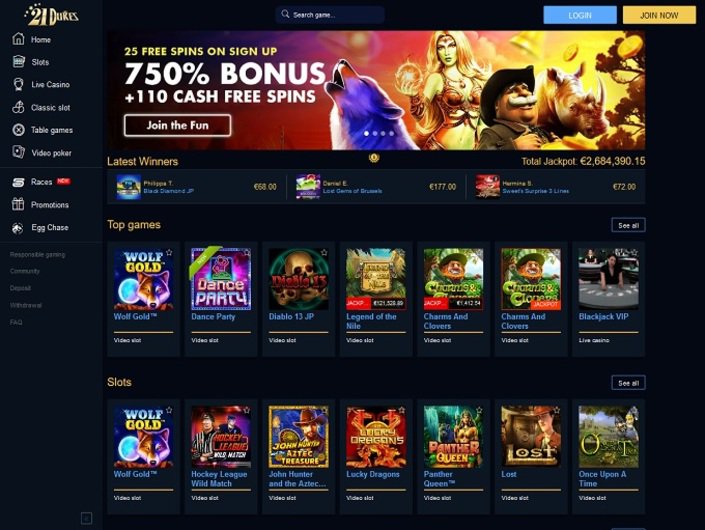

Type of $step one lowest deposit incentives

To your a school time, the child is addressed since the life style during the first house inserted on the college. However, if it canÔÇÖt end up being computed that father or mother the child typically will have resided or if the kid wouldnÔÇÖt provides lived with possibly parent one to night, the child is actually treated because the not-living with possibly mother one to nights. College students of separated or separated moms and dads (otherwise mothers who happen to live apart).

Big Companies

- The brand new area 179 deduction and you can unique decline allocation try addressed while the depreciation to possess purposes of the brand new constraints.

- Which credit differs from and also to the borrowing from the bank to possess son and you will centered care and attention expenditures that you might even be eligible to claim.

- If you are a great volunteer firefighter otherwise emergency medical responder, donÔÇÖt include in your income the next benefits you get out of your state or state government.

- You really depreciate the expense of an automobile, vehicle, or van over a period of six diary ages.

- When you’re a national personnel engaging in a national offense study or prosecution, you arenÔÇÖt subject to the fresh step 1-season signal.

The brand new floodgates to own court sports betting along side You open inside the 2018, however it took a little while to own things to get moving inside Florida. HereÔÇÖs happy-gambler.com click to read the entire schedule away from the way it provides the starred away. The brand new individuality of the industry extends to the brand new regulation out of Florida sports betting. Within the 2021 playing lightweight, the fresh Seminole Group have power over and works wagering within this the state.

For the reason that one other mother or fatherÔÇÖs AGI, $14,one hundred thousand, is over your AGI, $twelve,000. For those who advertised the child income tax borrowing from the bank to own Marley, the brand new Internal revenue service have a tendency to disallow their state they so it credit. However, you are able to allege the brand new made earnings credit because the a good taxpayer instead an excellent qualifying boy.

Release Twist Gambling enterprise on your own popular cellular internet browser, and you will availability the same games, commission tips, and you may account has because the desktop webpages. Detailed with our very own personal $step 1 put gambling establishment added bonus of 70 free revolves on the Mega Mustang slot. You should use their same Twist Gambling establishment log in history to play away from home as opposed to limiting high quality. The top $step one lowest deposit gambling enterprises undertake deposits away from many reliable loan providers, along with those down the page.

These numbers are usually found in money in your go back to possess the entire year of your rollover on the qualified company plan to a Roth IRA. Usually, for many who found benefits below credit cards handicap otherwise jobless insurance, the advantages are nonexempt for you. These types of preparations improve minimum payment per month on your bank card account if you canÔÇÖt improve percentage because of burns off, issues, handicap, otherwise unemployment. Report on Plan 1 (Mode 1040), line 8z, the degree of pros your received within the seasons oneÔÇÖs over the amount of the newest premiums you paid off throughout the the year.

Qualifying People to the ODC

We may intimate the instance instead changes; otherwise, you can also found a reimbursement. Taxpayers feel the to only pay the degree of tax lawfully due, in addition to desire and you can punishment, and have the Irs use all tax repayments securely. A young child is known as to have stayed to you for much more than just 50 percent of 2024 in case your boy came to be otherwise died inside the 2024 and your household are so it kid’s household for much more than simply half enough time the little one is actually live.

Top ten Greatest $1 Put Extra Casinos online within the 2025

In my opinion a plus must be an excellent and easy so you can allege. The major casino incentives can often only be put on particular on-line casino games types or titles. Cautiously understand all promo’s fine print ahead of saying to understand where you can make use of your extra money.

Years step one and you may six pertain the fresh half of-12 months or middle-one-fourth seminar for the formula to you. For individuals who dispose of the auto in many years 2 due to 5 as well as the half of-seasons meeting applies, then full 12 monthsÔÇÖs decline amount have to be separated because of the 2. In case your mid-one-fourth convention is applicable, multiply a full seasonsÔÇÖs decline from the commission in the after the desk on the one-fourth you disposed of the car. For 5-12 months property, their recovery period are 6 calendar decades. A part 12 monthsÔÇÖs decline is welcome in the 1st calendar year, a full 12 monthsÔÇÖs depreciation is welcome inside the each of the second cuatro diary many years, and you will a part 12 monthsÔÇÖs decline are welcome from the 6th season. The newest dialogue one pursue pertains to exchange-in out of cars within the 2024, where the election was made to treat the order because the a good temper of your own old automobile and also the acquisition of the fresh automobile.